News

Press Releases

WuXi AppTec Reports Strong Third-Quarter 2020 Results

2020/10/29

Revenue Growth Accelerated to 35.4% Year-Over-Year to RMB 4,583 Million

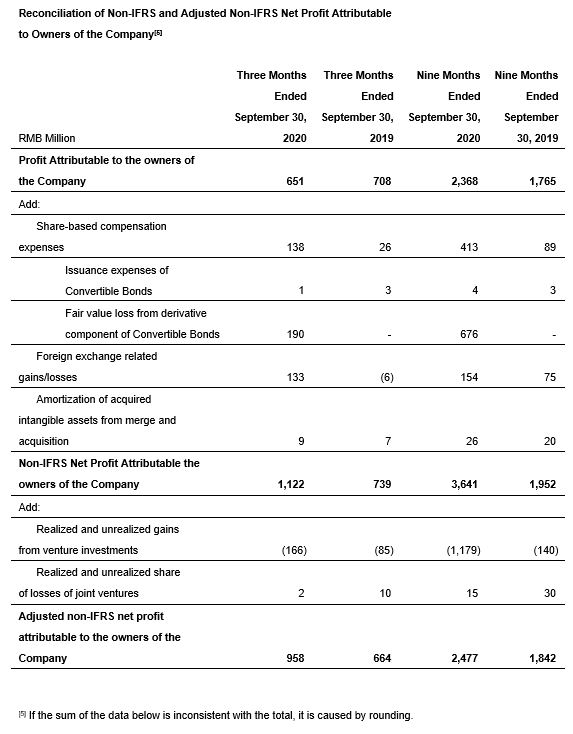

Adjusted Non-IFRS Net Profit Attributable to Owners of the Company Up 44.3% Year-Over-Year to RMB 958 Million

Adjusted Diluted Non-IFRS EPS Up 37.9% YoY to RMB0.40

WuXi AppTec Year-to-Date as of September 30, 2020 Results

Revenue Up 27.3% Year-Over-Year to RMB 11,815 Million

Adjusted Non-IFRS Net Profit Attributable to Owners of the Company Up 34.4% Year-Over-Year to RMB 2,477 Million

Adjusted Diluted Non-IFRS EPS Up 32.5% YoY to RMB1.06

SHANGHAI, Oct. 29, 2020 /PRNewswire/ -- WuXi AppTec Co., Ltd. (stock code: 603259.SH / 2359.HK), a company that provides a broad portfolio of R&D and manufacturing services that enable companies in the pharmaceutical, biotech and medical device industries worldwide to advance discoveries and deliver groundbreaking treatments to patients, is pleased to announce its financial results for the third quarter and nine months ended September 30, 2020 ("Reporting Period").

This document serves purely as a summary and is not intended to provide a complete representation of the relevant matters. For further information, please refer to the 2020 third quarterly report and relevant announcements published on the websites of the Shanghai Stock Exchange (www.sse.com.cn) and the Stock Exchange of Hong Kong (www.hkexnews.hk), and the designated media for dissemination of the relevant information. Investors are advised to exercise caution and be aware of the investment risks in dealing in the shares of the Company.

All financials disclosed in this press release are prepared based on International Financial Reporting Standards (or "IFRSs").

The 2020 Third-Quarter Report of the Company has not been audited.

Third-Quarter 2020 Financial Highlights

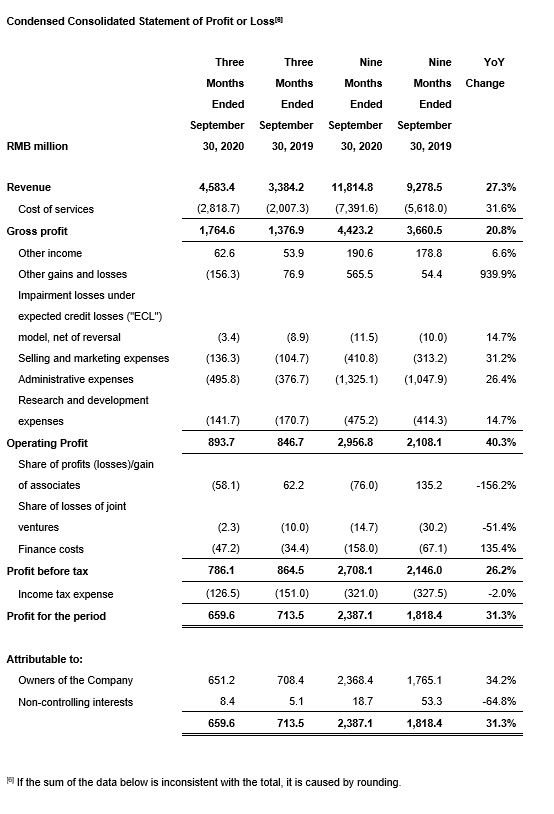

· Accelerated revenue growth of 35.4% year-over-year to RMB4,583 million.

- China-based laboratory services realized revenue of RMB2,338 million, representing a YoY growth of 38.9%. Both of our drug discovery services and laboratory testing services achieved strong growth. Our chemistry fee for services revenue grew about 53% and our drug safety assessment services revenue grew about 77%.

- CDMO services realized revenue of RMB1,548 million, representing a YoY growth of 54.9%. Our "Follow the Molecule" business model continued to perform very well.

- U.S.-based laboratory services realized revenue of RMB372 million, representing a YoY decline of 13.5%, mainly due to the impact of COVID-19 and customers' projects delay.

- Clinical research and other CRO services realized revenue of RMB315 million, representing a YoY growth of 16.8%. The revenue growth rate continued to improve quarter-over-quarter.

· Gross profit grew 28.2% year-over-year to RMB1,765 million. Gross profit margin was 38.5%, slightly lower than the 40.7% achieved in the third quarter 2019[1], mainly because of: (1) the impact of COVID-19 on our U.S.-based laboratory services and clinical research services business, (2) an increase in share-based compensation expenses.

· Non-IFRS gross profit grew 26.9% YoY to RMB1,826 million. Non-IFRS gross profit margin was 40.1% compared to 42.1% for the same period in 2019. (1) The non-IFRS gross profit margin of our China-based laboratory services and CDMO services were largely in line with that of third quarter 2019. (2) Due to the impact of COVID-19, the non-IFRS gross profit margin of our U.S.-based laboratory services and clinical research and other CRO services declined.

· Reported EBITDA down 10.4% Year-Over-Year to RMB1,035 million due to decrease of reported net profit.

· Adjusted EBITDA grew 24.9% Year-Over-Year to RMB1,383 million.

· Reported net profit attributable to owners of the Company declined 8.1% year-over-year to RMB651 million, mainly because: (1) In the third quarter of 2020, CNY appreciated sharply against the USD. We reported a RMB154 million net loss, due to realized and unrealized exchange loss of the proceeds of new H-Share placement and other USD assets held by the Company, partially offset by the gains from our foreign currency forward contracts. In the same period last year, we reported a RMB 4 million net gain. (2) Non-cash loss of RMB190 million from the derivative component of our convertible bonds due to the increase of our H share price.

· Adjusted non-IFRS net profit attributable to owners of the Company increased strongly 44.3% year-over-year to RMB958 million.

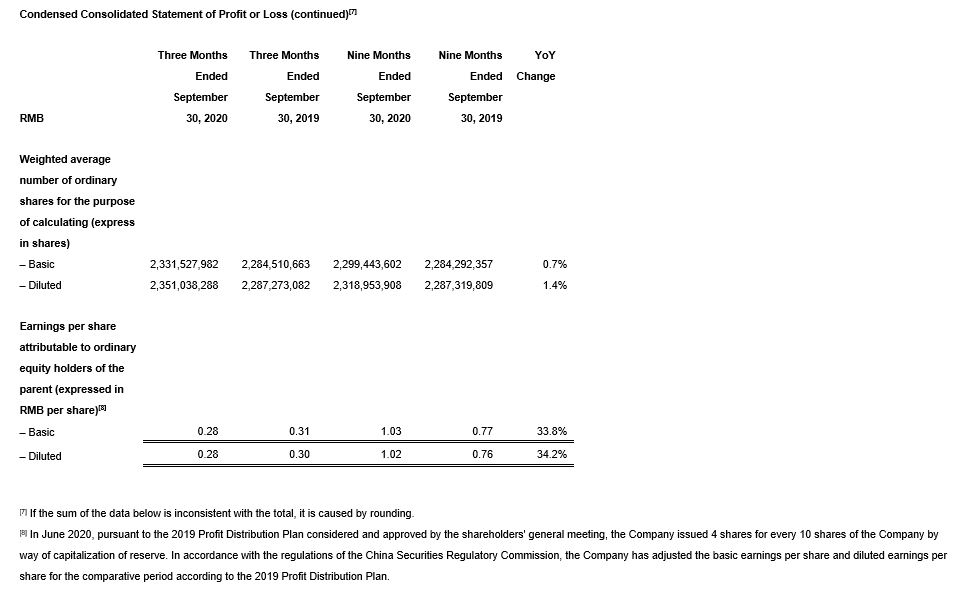

· Diluted EPS down 6.7% versus the same period last year while adjusted diluted non-IFRS EPS increased strongly by 37.9%.[2]

[1] If prepared under Accounting Standard for Business Enterprises of PRC, the gross profit grew 28.4% year-over-year to RMB1,772 million. Gross profit margin was 38.7%, slightly lower than the 40.8% achieved in the third quarter 2019.

[2] Gain in the fair value change of the investment portfolio of the company is RMB183 million in the current period, increased by RMB173 million compared with the gains in fair value of RMB10 million in the same period last year. Three months ended September 30, 2019 and three months ended September 30, 2020, we had a fully-diluted weighted average share count of 2,287,273,082 and 2,351,038,288 ordinary shares, respectively.

Year-to-Date 2020 Financial Highlights

· Strong revenue growth of 27.3% year-over-year to RMB11,815 million.

- China-based laboratory services realized revenue of RMB6,118 million, representing a YoY growth of 30.9%.

- CDMO services realized revenue of RMB3,710 million, representing a YoY growth of 36.5%.

- U.S.-based laboratory services realized revenue of RMB1,154 million, representing a YoY growth of 1.2%.

- Clinical research and other CRO services realized revenue of RMB815 million, representing a YoY growth of 9.9%.

· Gross profit grew 20.8% year-over-year to RMB4,423 million. Gross profit margin was 37.4%.[3]

· Non-IFRS gross profit grew 23.7% YoY to RMB4,743 million. Non-IFRS gross profit margin was 40.1%.

· Reported EBITDA grew 24.8% Year-Over-Year to RMB3,635 million.

· Adjusted EBITDA grew 27.5% Year-Over-Year to RMB3,833 million.

· Net profit attributable to owners of the Company grew 34.2% year-over-year to RMB2,368 million.

· Adjusted non-IFRS net profit attributable to owners of the Company grew 34.4% year-over-year to RMB2,477 million.

· Diluted EPS increased by 34.2% versus the same period last year while adjusted diluted non-IFRS EPS increased by 32.5%.[4]

[3] If prepared under Accounting Standard for Business Enterprises of PRC, the gross profit grew 21.1% year-over-year to RMB 4,440 million. Gross profit margin was 37.6%.

[4] The gains in the fair value of the investment portfolio of the company is RMB1,123 million in the first nine months, increased by RMB1,168 million compared with the losses in fair value of RMB 45 million in the same period last year. Nine months ended September 30, 2019 and nine months ended September 30, 2020, we had a fully-diluted weighted average share count of 2,287,319,809 and 2,318,953,908 ordinary shares, respectively.

Business Highlights

· For nine months ended September 30 2020, we added over 900 new customers, increasing our active customer count to more than 4,100. Our "long-tail" strategy and "Follow the Customer/Follow the Project/Follow the Molecule" business model continued to perform very well.

- Our global platform continued to enable innovation worldwide. During the reporting period, our overseas customers contributed RMB9,023 million revenue, representing a YoY growth of 25.3%. Our China customers contributed RMB2,792 million revenue, representing a YoY growth of 34.4%.

- We continued to expand our customer base and retain existing customers. During the reporting period, our existing customers contributed RMB11,109 million revenue, representing a YoY growth of 29.1%. Our newly added customers contributed RMB706 million revenue.

- We continued to execute our "long-tail" strategy and increased our support to large global pharmaceutical companies. During the reporting period, our global "long-tail" customers and China-based customers contributed RMB7,938 million revenue, representing a YoY growth of 28.4%. The top 20 global pharmaceutical companies contributed RMB3,877 million revenue, representing a YoY growth of 25.1%.

- We continued to increase customer conversion and enhance synergies across our platform. During the reporting period, customers using services from more than one of our business units contributed RMB10,164 million revenue, representing a YoY growth of 27.1%.

· We acquired Milestone Pharma to consolidate and expand the capacity of our analytical testing services.

· Target-to-Hit platform enabled 359 customers globally and realized about RMB140 million revenue, representing a YoY growth of about 92%, which will also create incremental business opportunities for our downstream business units.

· During the first nine months of 2020, our success-based drug discovery service unit submitted IND filings for 18 new chemical entities for our customers and obtained 20 CTAs. As of September 30, 2020, we have cumulatively submitted 103 NCE IND filings with the National Medical Products Administration (NMPA) for our customers and obtained 77 CTAs. As of September 30, 2020, there is 1 project in Phase III clinical trial, 9 projects in Phase II clinical trials, and 56 projects in Phase I clinical trials.

· During the first nine months of 2020, we signed 78 integrated WIND packages with our customers, helping many of our customers submit their IND packages for global filings and obtain CTAs under eCTD format.

· We added over 440 new molecules into our small molecule CDMO services pipeline. In addition to executing our 'follow-the-molecule' strategy, we also won 25 phase II/III projects externally transferred from our clients and their current CMOs. As of September 30, 2020, our small molecule CDMO pipeline has grown to more than 1,100 active projects, including 42 projects in Phase III clinical trials and 26 in commercial manufacturing.

· 4 WuXi STA sites passed China NMPA new drug pre-approval inspections (PAI) at the same time. This PAI success marked a milestone for STA with 4 records:

- It is WuXi STA's first drug product pre-approval inspection.

- It is the first regulatory inspection for WuXi STA's spray drying commercial manufacturing facility and process.

- This PAI is the first comprehensive inspection for WuXi STA's integrated and end-to-end CMC platform including both drug substance and drug product.

- It is the first PAI involving four WuXi STA sites at the same time.

· As of September 30, 2020, our U.S. cell and gene therapies CDMO business provided services for 33 clinical stage projects, including 22 projects in Phase I and 11 projects in Phase II/III. As of end of third quarter, 2020, the backlog of our cell and gene therapies CDMO business increased about 35% compared with the previous quarter. We expect about 2 to 3 products, including autologous cell therapy and allogeneic cell therapy products, will file for BLA with the FDA in 2021, which may become a significant growth driver for our U.S.-based laboratory services.

· Our clinical research services continued to enable customers in China and the U.S. During the reporting period:

- SMO maintained its No.1 leadership position in China, with 3,100+ CRCs stationed in 145 cities. CDS team was comprised of 810+ employees distributed in China and the U.S.

- The backlog of our clinical research services increased significantly compared with the same period last year. As of September 30, 2020, the backlog of our CDS services increased about 100% and the backlog of our SMO services increased about 45%.

- SMO team assisted in the market approval of 14 products for our customers, including the approval of China's first biosimilar product in the European Union. CDS team conducted 10 multi-regional clinical trials for our customers in the U.S. and China.

Management Comment

Dr. Ge Li, Chairman and CEO of WuXi AppTec, said, "We once again achieved accelerated revenue growth in the third quarter of 2020. The strong performance of our China-based laboratory services and CDMO services, as well as the gradual recovery of our clinical research and other CRO services, mitigated the challenges faced by our U.S.-based laboratory services due to the COVID-19 pandemic. We are delighted to see that our platform and business performed very well and we continued to meet customer demand and project delivery schedules during the pandemic. Through the end of September 2020, we added over 900 new customers and our total number of active customers now exceeds 4,100."

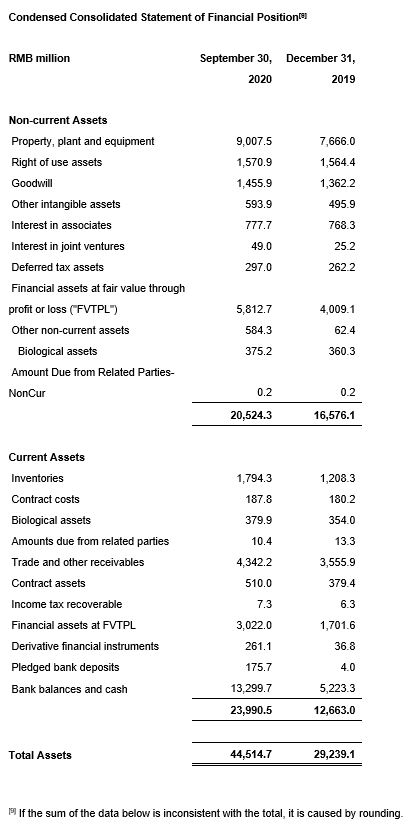

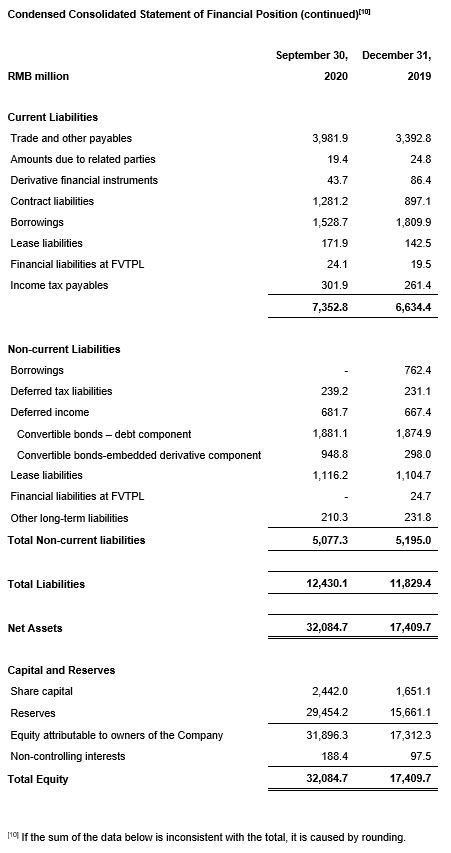

"Our global enabling platform and 'Follow the Customer/Follow the Project/Follow the Molecule' strategy continued to perform very well. In the third quarter, our China-based laboratory services as well as CDMO services revenue growth accelerated compared with the second quarter and we continued to gain market share across different business units. Our clinical research and other CRO services realized revenue growth and our backlog increased significantly. In spite of the impact of COVID-19, the backlog of our U.S.-based laboratory services grew strongly quarter-over-quarter. In the future, we expect commercial manufacturing projects under our CDMO services segment to become a significant revenue driver. The Company's financial position is very strong. In September 2020, after raising HK$7.29 billion through the placement of new H shares, we completed the non-public issuance of 62.7 million A shares, receiving approximately RMB6.46 billion in net proceeds and providing the Company with a strong balance sheet for capacity expansion, especially for our CDMO segment."

Dr. Ge Li concluded, "We are grateful for the dedication of our employees and the partnership with our global customers, and remain committed to working with them to enable scientific and pharmaceutical innovation worldwide during this pandemic and beyond. Looking ahead, we will continue to invest in new capabilities and capacities that help our global partners bring groundbreaking medicines and treatments to patients in need, realizing our vision that 'every drug can be made and every disease can be treated'."

About WuXi AppTec

WuXi AppTec provides a broad portfolio of R&D and manufacturing services that enable companies in the pharmaceutical, biotech and medical device industries worldwide to advance discoveries and deliver groundbreaking treatments to patients. As an innovation-driven and customer-focused company, WuXi AppTec helps our partners improve the productivity of advancing healthcare products through cost-effective and efficient solutions. With industry-leading capabilities such as R&D and manufacturing for small molecule drugs, cell and gene therapies, and testing for medical devices, WuXi AppTec's open-access platform is enabling more than 4,100 collaborators from over 30 countries to improve the health of those in need – and to realize our vision that "every drug can be made and every disease can be treated." Please visit: http://www.wuxiapptec.com

Forward-Looking Statements

This press release may contain certain "forward-looking statements" which are not historical facts, but instead are predictions about future events based on our beliefs as well as assumptions made by and information currently available to our management. Although we believe that our predictions are reasonable, future events are inherently uncertain and our forward-looking statements may turn out to be incorrect. Our forward-looking statements are subject to risks relating to, among other things, the ability of our service offerings to compete effectively, our ability to meet timelines for the expansion of our service offerings, our ability to protect our clients' intellectual property, unforeseeable international tension, competition, the impact of emergencies and other force majeure. Our forward-looking statements in this press release speak only as of the date on which they are made, and we assume no obligation to update any forward-looking statements except as required by applicable law or listing rules. Accordingly, you are strongly cautioned that reliance on any forward-looking statements involves known and unknown risks and uncertainties. All forward-looking statements contained herein are qualified by reference to the cautionary statements set forth in this section. All information provided in this press release is as of the date of this press release and are based on assumptions that we believe to be reasonable as of this date, and we do not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Non-IFRS Financial Measures

We provide Non-IFRS gross profit, exclude the impact in revenue and cost from effective hedge accounting, share-based compensation expenses and amortization of intangible assets acquired in business combinations, and Non-IFRS net profit attributable to owners of the Company, which exclude share-based compensation expenses, listing expenses and issuance expenses of convertible bonds, fair value gain or loss from derivative component of convertible bonds, foreign exchange-related gains or losses and amortization of intangible assets acquired in business combinations. We also provide adjusted Non-IFRS net profit attributable to owners of the Company and earnings per share, which further exclude realized and unrealized gains or losses from our venture investments and joint ventures. We further provide EBITDA and adjusted EBITDA. Neither of above is required by, or presented in accordance with IFRS. We believe that the adjusted financial measures used in this press release are useful for understanding and assessing our core business performance and operating trends, and we believe that management and investors may benefit from referring to these adjusted financial measures in assessing our financial performance by eliminating the impact of certain unusual, non-recurring, non-cash and non-operating items that we do not consider indicative of the performance of our core business. Such Non-IFRS financial measures, the management of the Company believes, is widely accepted and adopted in the industry the Company is operating in. However, the presentation of these adjusted Non-IFRS financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with IFRS. You should not view adjusted results on a stand-alone basis or as a substitute for results under IFRS, or as being comparable to results reported or forecasted by other companies.

For more information, please contact:

Mr. Tianyi Zhang (For investors)

IR Director

Email: zhang_tianyi0101@wuxiapptec.com

Mr. Davy Wu (For media)

PR Director

Email: davy_wu@wuxiapptec.com