News

Press Releases

WuXi AppTec Reports Record Results in 2022

2023/03/20

Revenue Up 71.8% Year-Over-Year to RMB39,355 Million

Net Profit Attributable to Owners of the Company Up 72.9% Year-Over-Year to RMB8,814 Million

Diluted Earnings Per Share (EPS) Up 63.0% Year-Over-Year to RMB2.82

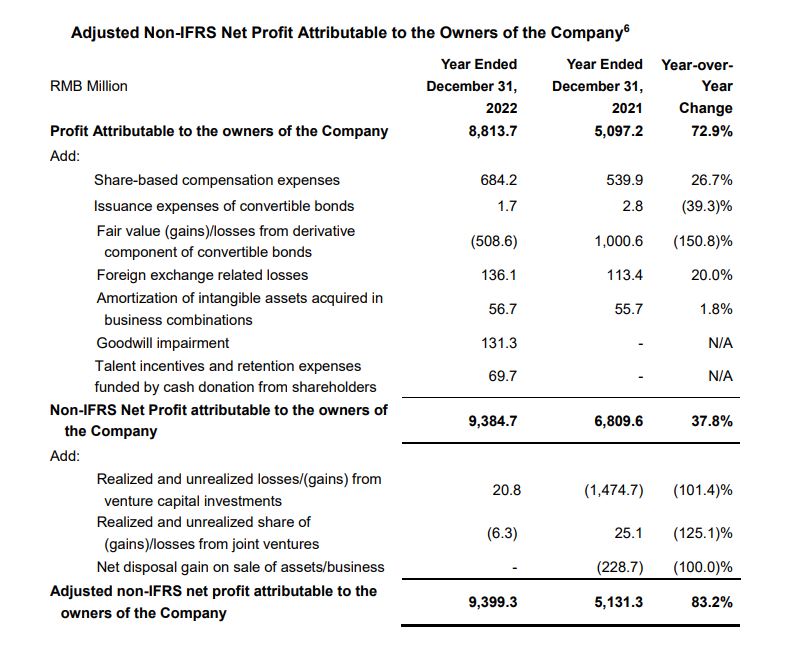

Adjusted Non-IFRS Net Profit Attributable to Owners of the Company Up 83.2% Year-Over-Year to RMB9,399 Million

Adjusted Non-IFRS Diluted EPS Up 81.7% Year-Over-Year to RMB3.18[1]

Operating Cash Flow Up 133.6% Year-Over-Year to RMB10,230 Million, and Free Cash Flow Turned Positive

Company to Pay Cash Dividend of RMB2,644 Million, 30% of 2022 Net Profit

(SHANGHAI, March 20, 2023) — WuXi AppTec (stock code: 603259.SH / 2359.HK), a global company that provides a broad portfolio of R&D and manufacturing services that enable companies in the pharmaceutical, biotech and medical device industries to advance discoveries and deliver groundbreaking treatments to patients, is pleased to announce its annual results for the year ending December 31, 2022 (“Reporting Period”).

This release provides a summary of the results and is not intended to be a comprehensive report. For additional information, please refer to the 2022 Annual Report and other relevant announcements published on the websites of the Shanghai Stock Exchange (www.sse.com.cn) and the Stock Exchange of Hong Kong (www.hkexnews.hk), and the designated media for dissemination of the relevant information. Investors are advised to exercise caution and be aware of the investment risks in trading Company shares.

All financial information disclosed in this press release is prepared based on International Financial Reporting Standards (IFRS), in currency of RMB.

The 2022 Annual Report of the Company has been audited.

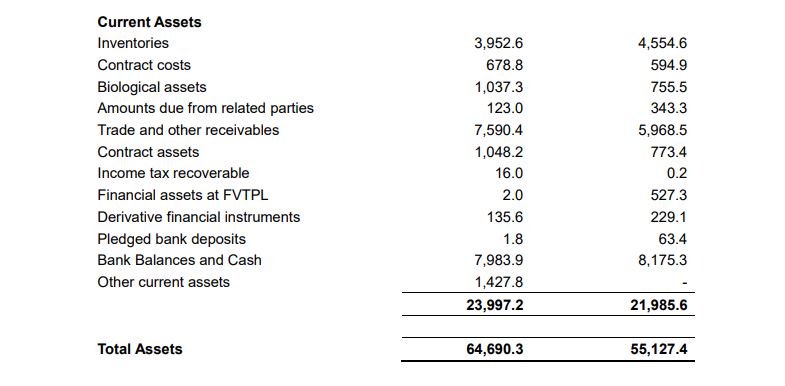

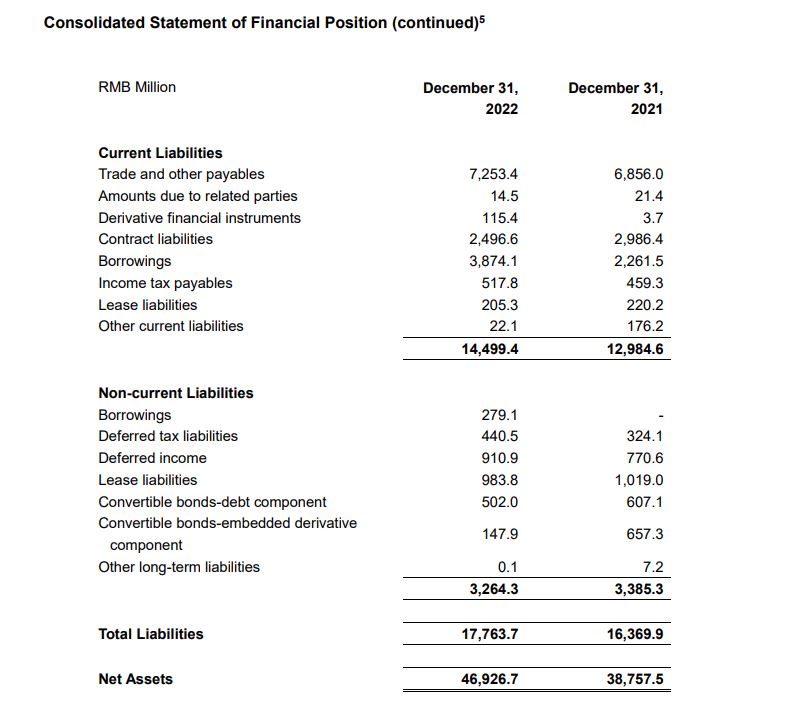

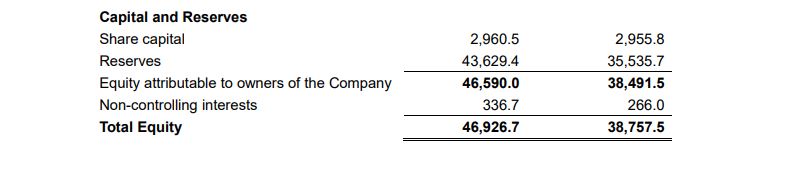

2022 Financial Highlights

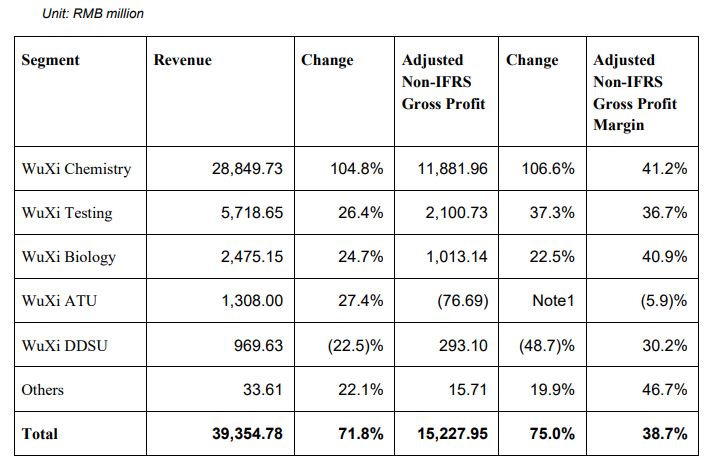

In 2022, we achieved record revenue growth in a very challenging operating environment. Revenue grew 71.8% year-over-year to RMB39,355 million. This is primarily attributable to the Company’s continuing strong execution of our unique Contract Research, Development and Manufacturing Organization (CRDMO) business model to achieve synergy and strong growth:

●WuXi Chemistry revenue grew 104.8% to RMB28,850 million and adjusted non-IFRS gross profit grew 106.6% to RMB11,882 million, with a gross profit margin of 41.2%.

●WuXi Testing revenue grew 26.4% to RMB5,719 million and adjusted non-IFRS gross profit grew 37.3% to RMB2,101 million, with a gross profit margin of 36.7%.

●WuXi Biology revenue grew 24.7% to RMB2,475 million and adjusted non-IFRS gross profit grew 22.5% to RMB1,013 million, with a gross profit margin of 40.9%.

●WuXi ATU revenue grew 27.4% to RMB1,308 million and adjusted non-IFRS gross profit was RMB(77) million, with a gross profit margin of -5.9%

●WuXi DDSU revenue declined 22.5% to RMB970 million and adjusted non-IFRS gross profit declined 48.7% to RMB293 million, with a gross profit margin of 30.2%.

Notes: 1. Adjusted Non-IFRS Gross Profit of WuXi ATU was RMB(76.69) million in 2022, compared to RMB11.43 million in 2021, a decrease of RMB88.11 million.

2. Any sum of the data above that is inconsistent with the total is due to rounding.

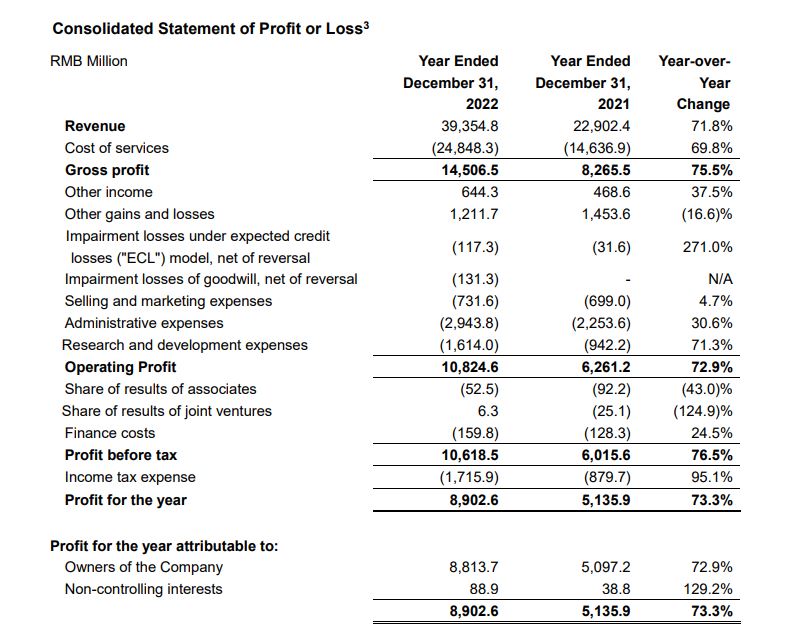

●IFRS gross profit increased 75.5% year-over-year to RMB14,507 million. Gross profit margin was 36.9%.[2]

●Adjusted non-IFRS gross profit increased 75.0% year-over-year to RMB15,228 million. Adjusted non-IFRS gross margin was 38.7%.

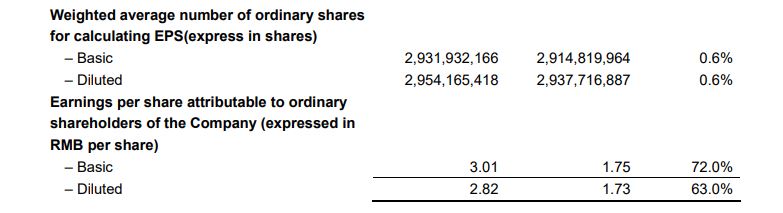

●Net profit attributable to owners of the Company increased 72.9% year-over-year to RMB8,814 million.

●Adjusted non-IFRS net profit attributable to owners of the Company increased 83.2% year-over-year to RMB9,399 million.

●Diluted EPS increased 63.0% year-over-year to RMB2.82, while adjusted diluted non-IFRS EPS increased by 81.7% year-over-year to RMB3.18.

●Company’s Board of Directors decided to distribute RMB 8.9266 cash dividend for every 10 shares (30% payout ratio, RMB2,644 million cash dividend in total).

2022 Business Operation Highlights

●We continued to expand our customer base globally. In 2022, demand for our services was very strong and we grew our customer base to more than 5,950 active accounts by adding over 1,400 new customers. We continued to optimize our cross-platform synergies to better serve our customers worldwide, strengthen our unique competitive advantage as a fully integrated Contract Research, Development and Manufacturing Organization (CRDMO) and Contract Testing, Development and Manufacturing Organization (CTDMO) platform, and provide one-stop services for our clients from discovery to development and manufacturing. Revenue growth was demonstrated across our expanding global customer base:

●Revenue from US-based customers grew 113% to RMB25,884 million; revenue from Europe-based customers grew 19% to RMB4,432 million; revenue from China-based customers grew 30% to RMB7,526 million; and revenue from other regions grew 23% to RMB1,512 million.

●We remain focused on delivering high quality services with great efficiency to retain loyal customers for the long term. During the Reporting Period, revenue from existing clients grew 77% to RMB37,781 million and new clients contributed RMB1,573 million in revenue.

●During the Reporting Period, revenue from the top 20 global pharmaceutical companies grew 174% to RMB18,421 million; revenue generated from all other customers grew 30% to RMB20,934 million.

●Our unique positioning across the pharmaceutical development value chain drove our “follow-the-customer” and “follow-the-molecule” strategies and enhanced synergies across our business segments. Customers using services from multiple business units contributed RMB36,736 million in revenue, growing 87% year-over-year.

●WuXi Chemistry: CRDMO integrated business model drove revenue doubled

-Revenue grew 104.8% to RMB28,850 million and adjusted non-IFRS gross profit grew 106.6% to RMB11,882 million, with a gross margin of 41.2%. Excluding COVID-19 commercial projects, WuXi Chemistry revenue grew strongly by 39.7%. Revenue from new modalities-related services (TIDES) grew 158.3% to RMB2,037 million.

-Revenue from discovery chemistry services (“R”) grew 31.3% to RMB7,213 million.

i. Our industry-leading small molecule drug discovery platform delivered more than 400,000 custom synthesized new compounds to our clients in the past twelve months. Through our small molecule discovery services, we enabled our customers to accelerate their research while generating opportunities for our downstream business units. As part of our “follow-the-customer” and “follow-the-molecule” strategies, we established trusted partnerships with our global customers, supporting the rapid and sustainable growth of our CRDMO business.

ii. We continued executing our “long-tail” strategy. Demand from “long-tail” customers in small molecule and new modality-related discovery services continued to grow.

-Revenue from development and manufacturing (D&M) services grew 151.8% to RMB21,637 million.

i. During the Reporting Period, we won 973 new molecules to our D&M pipeline, including 1 new molecule at the commercial stage. To date, our D&M pipeline consists of 2,341 molecules, including 50 in commercial stage, 57 in phase III, 293 in phase II and 1,941 in phase I and pre-clinical stages.

ii. D&M services for new modalities is gaining strong momentum. During the Reporting Period, the number of TIDES (mainly oligo and peptides) D&M clients increased 81% to 103 customers, and the number of TIDES molecules increased 91% to 189 molecules. Revenue from TIDES D&M business grew 337% to RMB1,578 million. Our TIDES business has a unique end to end CRDMO platform, enabling R&D and production of multiple complex conjugates. By Feb. 2023, we have in total 27 oligo production lines, over 10,000 liter peptide solid-phase synthesizers, and an R&D team of over 1,000 people. Our late-stage and commercial project delivery capabilities are favored by customers, supporting large scale production with industry leading speed. Furthermore, our integrated API plus DP platform have completed 16 CMC projects in 2022.

-We continued our capacity expansion to meet customer demands. During the Reporting Period, we began operations in Changzhou Phase 3 facility, Changshu facility and our Wuhan campus, which further enhanced our global integrated CRDMO platform capabilities and capacities. We continued the design and construction of facilities in Changzhou and Wuxi city in China, Delaware in the U.S. and Tuas in Singapore, aiming to better serve our global customers’ future needs. Three sites located in Changzhou, Shanghai Waigaoqiao and Wuxi city were awarded “Silver” sustainability ratings by EcoVadis with excellent results, representing a leading position in the industry.

●WuXi Testing: strong growth driven by lab testing services

-Revenue from WuXi Testing grew 26.4% to RMB5,719 million and adjusted non-IFRS gross profit grew 37.3% to RMB2,101 million, with a gross margin of 36.7%.

-Revenue from lab testing services grew 36.1% year-over-year to RMB4,144 million.

i. The Company provides a full range of laboratory testing services for our customers, including drug metabolism and pharmacokinetics (DMPK), toxicology, and bioanalysis for drug development testing as well as medical device testing. We provide customers with high-quality services, realize "one report for global submission," and enable customers to save time, reduce costs and increase efficiency. By maintaining close collaborative relationships with our customers based on our “follow-the-molecule” and “follow-the-customer” strategies, existing customers account for over 60% of our customer base. We leveraged our integrated WuXi AppTec Investigational New Drug (WIND) program to generate preclinical data package and prepare global regulatory submissions of investigational new drug (IND), expediting the IND application process for many customers worldwide.

ii. Drug safety evaluation services achieved strong revenue growth of 46% year-over-year. We maintained our industry-leading position in Asia Pacific for drug safety evaluation services that meet global regulatory requirements.

iii. Our largely US-based medical device testing business has turned around and grew 33% year-over-year.

iv. On the capacity expansion side, 55,000 square meters laboratory are under construction in Suzhou and Qidong for 2023 delivery.

-Our clinical CRO & SMO (Site Management Organization) reached a revenue of RMB1,575 million, representing year-over-year growth of 6.4%, due in part to the impacts of COVID-19 pandemic in many cities across China in 2022.

v. For clinical CRO, despite challenges in 2022, the Company provided services to approximately 200 projects, enabling our customers to obtain 15 IND approvals.

vi. For SMO, the Company maintained No.1 leadership position in China and continued to grow. Our SMO business maintained strong growth amid multiple rounds of lockdown in 2022, and continued to gain market share in multiple therapeutic areas (lung cancer, breast cancer, dermatology, cardiovascular disease, ophthalmology, rheumatology, and nervous system etc.). As of the end of 2022, our SMO business maintained approximately 4,700 staff across around 150 cities in China, providing services at more than 1,000 hospitals. During the Reporting Period, revenue from our SMO business grew 23.5% and backlog grew 35.6%. In 2022, our SMO business supported 35 new drug approvals for clients.

vii. Clinical CRO and SMO businesses leverage the strength of our Lab Testing platform to drive conversion. By leveraging our strong pre-clinical testing services, we have successfully converted 17 preclinical projects to clinical projects in 2022.

●WuXi Biology: demand for our broad biology services drove growth with strong contribution from new modalities related services

-Revenue from WuXi Biology grew 24.7% to RMB2,475 million and adjusted non-IFRS gross profit grew 22.5% to RMB1,013 million, with a gross margin of 40.9%. Although revenue growth in the second quarter was temporarily impacted by the ongoing effects of the COVID-19 epidemic in Shanghai, business recovered in the second half due to the dedication of our employees.

-The Company has one of the largest discovery biology enabling platform, with more than 3,000 experienced scientists who provide comprehensive biology services covering all major stages and therapeutic areas of drug discovery. The Company has established 3 centers of excellence for non-alcoholic steatohepatitis (NASH), anti-viral, neuroscience and aging.

-Both our cancer discovery service and our rare and immune disease service continued to grow, providing customers with integrated high-quality services from target discovery to clinical biomarker detection.

-The Company has a leading DNA Encoded Library (DEL) and compound generation platform with over 90 billion compounds, 6,000 unique proprietary scaffolds and 35,000 building blocks, providing these services for more than 1,500 customers. A customer advanced a project into clinical stage in 2022 based on the hits generated using our DEL screening technology. This was the first reported clinical candidate from our DEL hits, which is also an important validation of our platform.

-The Company continues to build its biology capabilities for new modalities, including target protein degradation, nucleic acid-based and conjugated modalities, oncolytic virus, vector platform, and novel drug delivery vehicles. During the Reporting Period, WuXi Biology revenue from new modalities grew strongly by 90%. Its revenue contribution grew to 22.5% in 2022 from 14.6% in 2021, suggesting that new modalities-related biology services have become an increasingly important growth driver.

●WuXi ATU: CTDMO business model drove growth

-Revenue from WuXi ATU grew 27.4% year over year to RMB1,308 million and adjusted non-IFRS gross profit was RMB-77 million, with a gross margin of -5.9%. Revenue from our Testing service grew 36%, and revenue from our Development service grew 43%. Gross profit declined largely due to under-utilized capacity at the newly built Shanghai Lingang site.

-During the Reporting Period, the Company focused on improving our CTDMO integrated enabling platform and strengthened capabilities and capacities. We provided development and manufacturing services for 68 projects, including 50 pre-clinical and Phase I projects, 10 Phase II projects, and 8 Phase III projects (2 projects have filed BLA, and 2 projects are in BLA preparation stage). For the 2 projects filed for BLA, one is a TIL product for a US client, which is the world’s first innovative TIL-based therapy to be approved by FDA, and the other one is LVV used in a CAR-T product in China for a Chinese client. If they proceed as planned, we expect to have commercial stage projects in the second half of 2023.

-Our unique CTDMO platform has driven us to capture significant business opportunities. In 2022, we signed a tech transfer agreement to manufacture a blockbuster commercial CAR-T product. In August, we announced Licensing Agreement with Janssen for TESSA™.

●WuXi DDSU: business continues evolving in 2022 to better provide innovative drug discovery services to customers

-Revenue from WuXi DDSU declined 22.5% to RMB970 million and adjusted non-IFRS gross profit declined 48.7% to RMB293 million, with a gross margin of 30.2%. DDSU’s revenue decline was mainly due to our business transition to focus on fewer but more innovative projects to meet customers’ demand for novel drug candidates. The future revenue growth will gradually come from royalty income.

-In 2022, our success-based drug discovery service unit filed INDs for 28 drug candidates and obtained 34 Clinical Trial Approvals (CTAs). As of the end of 2022, we have cumulatively submitted 172 new chemical entity IND filings with the National Medical Products Administration (NMPA) and obtained 144 CTAs, with 1 project in NDA review stage, 7 projects in Phase III, 24 projects in Phase II, and 75 projects in Phase I. And by Mar 20, 2023, we have 2 projects in NDA review stage. We will begin receiving royalty income once our customers launch these products in the market. We expect to start receiving royalty income from approved products beginning 2023, which is estimated to grow with about 50% CAGR over the next 10 years as more and more products commercialized by DDSU customers.

-Currently, we support 15 pre-clinical projects for customers in new modalities that include Peptide/Peptide-Drug-Conjugation (PDC), protein degraders and oligo. Several of these projects have filed IND in 2022, and multiple other projects are expected to file IND in early 2023.

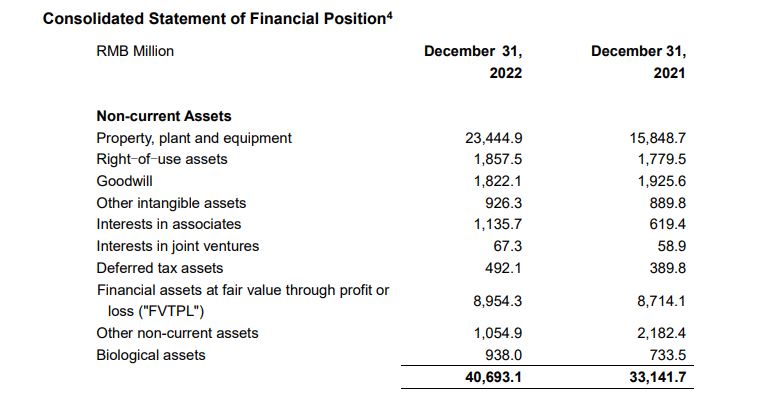

●The unique CRDMO and CTDMO business model of the Company continues to successfully drive record high financial performance. Our business continued its healthy growth while large scale commercial production projects generated strong cash flow in 2022. Our operating cash flow in 2022 represented an accelerated year-over-year growth of 133.6%. Free cash flow turned positive in 2022.

2023 Outlook

On top of an exceptionally strong year of 2022, we expect revenue growth of 5-7% in 2023. Excluding COVID-19 commercial revenues, WuXi Chemistry expects to grow 36-38%, and TIDES (new modalities business in WuXi Chemistry) expects to grow as twice the speed of overall WuXi Chemistry. Other business segments (WuXi Testing, WuXi Biology, WuXi ATU) expect to grow 20-23%. WuXi DDSU will continue business transition, and expect to be down more than 20%.

The Company will focus on continuous improvement of operating efficiency in 2023 to drive profitability and free cash flow growth. Adjusted non-IFRS Gross Profit expects to increase 12-14% year-over-year, with further improved operating efficiency, which will be conducive to the growth of Adjusted non-IFRS Net Income. Free cash flow will continue to be positive in 2023, and expect to increase by 600-800%. Capex spending expects to be RMB 8-9 billion, resulting from better asset utilization and efficiency improvement, with no impact on long-term growth. We will continue to invest in new capabilities and capacities to better serve global customer demands, and promote future growth of the Company.

Our commitment to ESG

As an enabler of innovation, a trusted partner, and a contributor to the global healthcare industry, the Company is committed to environmental protection and sustainability, and to being a good global corporate citizenship.

Our outstanding ESG performance has been recognized by major global ESG rating agencies. In 2022, the Company received an "AA" rating from MSCI for a second consecutive year, and ranked in the top 2% for ESG ratings by Sustainalytics in the global pharmaceutical industry. Meanwhile, the Company was named to the 2022 Dow Jones Sustainability Index (both World and Emerging Markets) and was included in the S&P Global Sustainability Yearbook 2023 for the first time with an “Industry Mover” award. In addition, the Company received recognitions in various ESG ratings, such as a leadership level of “A-” in the CDP Climate Change rating. In EcoVadis assessment on suppliers’ responsibility, the Company was awarded a “Bronze” rating, and three sites in Changzhou, Shanghai Waigaoqiao and Wuxi city received “Silver” ratings.

In 2022, our carbon emission intensity, energy consumption intensity and water use intensity reduced by 17.3%, 19.0%, and 23.4%, respectively, compared to the baseline of 2021.

Management Comment

Dr. Ge Li, Chairman and CEO of WuXi AppTec, said, “We achieved record growth for 2022. Our revenue increased 71.8% year-over-year and our adjusted non-IFRS net profit attributable to owners of the company increased 83.2% year-over-year. Our third-quarter revenue reached the milestone of over RMB 10 Billion for the first time in our history. WuXi AppTec’s performance during 2022 demonstrated that the Company’s unique CRDMO and CTDMO business models allow us to better meet growing demands from customers worldwide and continue to drive rapid growth for the Company.”

“In 2022, while COVID-19 continued to create uncertainty for many around the world, we effectively implemented our business continuity plan and leveraged our robust supply chain network to support our customers’ lifesaving work. We remain committed to prioritizing our customers’ needs. The Company will further enhance our capacity and capabilities and continuously improve our operating efficiency, to support our partners in their efforts to bring groundbreaking therapies to patients around the world. Driven by CRDMO and CTDMO business models, the Company is full of confidence to continue to grow and maintain our leading position as a global pharmaceutical R&D service platform.”

“In 2022, we continued to integrate ESG into every aspect of our business operations and achieved excellent results. The Company remains steadfast in ‘doing the right thing and doing it right.’ We will keep prioritizing our ESG commitments while enabling our customers’ discovery, development and manufacturing of innovative medical solutions for those in need.”

[1] In 2021 and 2022, WuXi AppTec had a fully-diluted weighted average share count of 2,937,716,887 and 2,954,165,418 ordinary shares, respectively.

[2] If prepared under Accounting Standard for Business Enterprises of PRC, the gross profit grew 76.6% year-over-year to RMB14,678 million. Gross profit margin was 37.3%.

[3] If the sum of the data below is inconsistent with the total, it is caused by rounding.

[4] If the sum of the data below is inconsistent with the total, it is caused by rounding.

[5] If the sum of the data below is inconsistent with the total, it is caused by rounding.

[6] If the sum of the data below is inconsistent with the total, it is caused by rounding.

About WuXi AppTec

As a global company with operations across Asia, Europe, and North America, WuXi AppTec provides a broad portfolio of R&D and manufacturing services that enable the global pharmaceutical and healthcare industry to advance discoveries and deliver groundbreaking treatments to patients. Through its unique business models, WuXi AppTec’s integrated, end-to-end services include chemistry drug CRDMO (Contract Research, Development and Manufacturing Organization), biology discovery, preclinical testing and clinical research services, cell and gene therapies CTDMO (Contract Testing, Development and Manufacturing Organization), helping customers improve the productivity of advancing healthcare products through cost-effective and efficient solutions. WuXi AppTec received an AA ESG rating from MSCI in 2022 and its open-access platform is enabling more than 5,950 customers from over 30 countries to improve the health of those in need – and to realize the vision that "every drug can be made and every disease can be treated." Please visit: http://www.wuxiapptec.com

Forward-Looking Statements

This press release may contain certain “forward-looking statements” which are not historical facts, but instead are predictions about future events based on our beliefs as well as assumptions made by and information currently available to our management. Although we believe that our predictions are reasonable, future events are inherently uncertain and our forward-looking statements may turn out to be incorrect. Our forward-looking statements are subject to risks relating to, among other things, the ability of our service offerings to compete effectively, our ability to meet timelines for the expansion of our service offerings, our ability to protect our clients’ intellectual property, unforeseeable international tension, competition, the impact of emergencies and other force majeure. Our forward-looking statements in this press release speak only as of the date on which they are made, and we assume no obligation to update any forward-looking statements except as required by applicable law or listing rules. Accordingly, you are strongly cautioned that reliance on any forward-looking statements involves known and unknown risks and uncertainties. All forward-looking statements contained herein are qualified by reference to the cautionary statements set forth in this section. All information provided in this press release is as of the date of this press release and are based on assumptions that we believe to be reasonable as of this date, and we do not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Use of Non-IFRS and Adjusted Non-IFRS Financial Measures

We provide non-IFRS gross profit and non-IFRS net profit attributable to owners of the Company, which exclude share-based compensation expenses, issuance expenses of convertible bonds, fair value gain or loss from derivative component of convertible bonds, foreign exchange-related gains or losses, amortization of intangible assets acquired in business combinations, goodwill impairment, etc. We also provide adjusted non-IFRS net profit attributable to owners of the Company and earnings per share, which further exclude realized and unrealized gains or losses from our venture capital investments and joint ventures. Neither is required by, or presented in accordance with IFRS.

We believe that the adjusted financial measures used in this press release are useful for understanding and assessing our core business performance and operating trends, and we believe that management and investors may benefit from referring to these adjusted financial measures in assessing our financial performance by eliminating the impact of certain unusual, non-recurring, non-cash and non-operating items that we do not consider indicative of the performance of our core business. Such adjusted non-IFRS net profit attributable to owners of the Company, the management of the Company believes, is widely accepted and adopted in the industry the Company is operating in. However, the presentation of these adjusted non-IFRS financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with IFRS. You should not view adjusted results on a stand-alone basis or as a substitute for results under IFRS, or as being comparable to results reported or forecasted by other companies.

For more information, please contact:

Ms. Ruijia Tang (for investors)

IR Director

Email: tang_ruijia@wuxiapptec.com

Media Contact

Email: mediainquiries@wuxiapptec.com