News

Press Releases

WuXi PharmaTech Announces Third-Quarter 2015 Results

2015/11/03

SHANGHAI, Nov. 3, 2015 -- WuXi PharmaTech (Cayman) Inc. ("WuXi" or the "Company") (NYSE: WX) announces the following financial information for the third quarter ended September 30, 2015.

Third-Quarter 2015 Highlights

- Net Revenues Increased 23.1% Year Over Year to $213.6 Million

- GAAP Diluted Earnings Per ADS Declined 53.7% Year Over Year to $0.21

- Non-GAAP Diluted Earnings Per ADS Attributable to WuXi Shareholders Decreased 41.8% Year Over Year to $0.31, Reflecting Exclusion of Share-Based Compensation of $0.09, Amortization of Acquired Intangible Assets of $0.02, and Deferred Tax Impact Related to Acquired Intangible Assets of ($.01)

- Mark-to-Market Losses on Foreign-Exchange Forward Contracts of $7.3 Million and Realized Losses on Settled Foreign-Exchange Forward Contracts of $1.6 Million Resulted from RMB Depreciation Against the U.S. Dollar in the Quarter

Third-Quarter 2015 GAAP Results

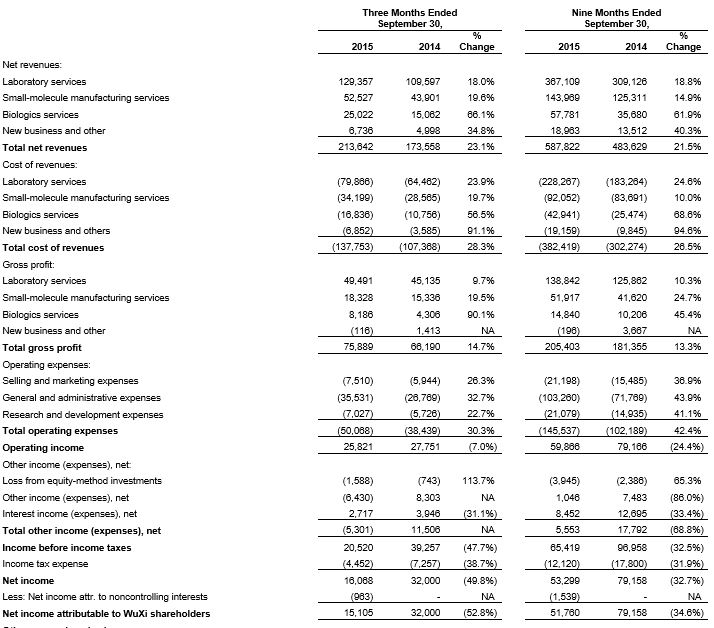

Third-quarter 2015 net revenues increased 23.1% year over year to $213.6 million. Laboratory Services revenue grew 18.0%, driven by our comprehensive and integrated drug discovery and development services.

Revenue growth of 19.6% in Small-Molecule Manufacturing Services resulted from strong demand in both research manufacturing and commercial manufacturing. Biologics Services revenue had strong growth of 66.1% year over year from both development and manufacturing. Revenue growth of 34.8% in New Businesses and Other related mainly to the significant revenue increase in clinical site management services in China, offset by slower than expected growth in the emerging new businesses such as genomics, China healthcare initiatives, and e-commerce.

Third-quarter 2015 GAAP gross profit increased 14.7% year over year to $75.9 million due to 23.1% revenue growth, partially offset by increased labor costs in China and investments in new businesses. Gross margin decreased year over year to 35.5% from 38.1%. Gross margin in Laboratory Services decreased year over year to 38.3% from 41.2% due to increased labor costs in China and investments in new businesses. Gross margin in Small-Molecule Manufacturing Services was unchanged at 34.9%. The increase in gross margin in Biologics Services year over year to 32.7% from 28.6% was due to efficiencies of scale. Gross margin in New Businesses and Other decreased year over year to (1.7%) from 28.3% mainly as a result of investments in genomics and bioinformatics.

Third-quarter 2015 GAAP operating income decreased 7.0% year over year to $25.8 million mainly due to investments in new businesses, including increased selling and marketing, general and administrative, and research and development expenses and transaction expenses related to the proposed privatization, partially offset by the 14.7% increase in gross profit. Operating margin declined to 12.1% from 16.0% due to these increased operating expenses.

Third-quarter 2015 GAAP net income decreased 49.8% year over year to $16.1 million mainly due to an unfavorable change of $9.4 million in mark-to-market gains and losses on foreign-exchange forward contracts (losses of $7.3 million in the third quarter of 2015 compared to gains of $2.1 million in the third quarter of 2014), an adverse change of $3.1 million in realized gains and losses on settled foreign-exchange forward contracts (losses of $1.6 million in the third quarter of 2015 compared to gains of $1.5 million in the third quarter of 2014), the 7.0% year-over-year decrease in operating income, larger equity-method investment losses from our joint ventures with PRA and MedImmune and other equity-method investments, and higher interest expense due to higher loan balances needed to support increased investment.

Third-quarter 2015 GAAP net income attributable to WuXi shareholders decreased 52.8% year over year to $15.1 million mainly due to the 49.8% year-over-year decrease in net income and net income attributable to non-controlling interests of $1.0 million in the third quarter of 2015.

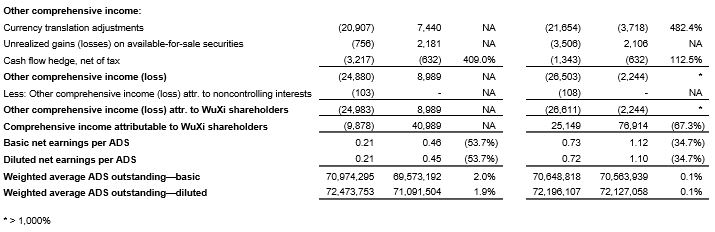

Third-quarter 2015 GAAP diluted earnings per ADS attributable to WuXi shareholders decreased 53.7% year over year to $0.21 due to the 52.8% decrease in net income attributable to WuXi shareholders and a higher number of outstanding ADSs as a result of share issuances relating to the XenoBiotic Laboratories acquisition and vesting of restricted stock units. Third-quarter 2015 GAAP comprehensive income/loss attributable to WuXi shareholders was a $9.9 million loss versus income of $41.0 million in the third quarter of 2014 mainly due to the 52.8% decrease in net income and unfavorable changes in currency translation adjustments, unrealized gains and losses on available-for-sale securities, and cash flow hedges, net of tax.

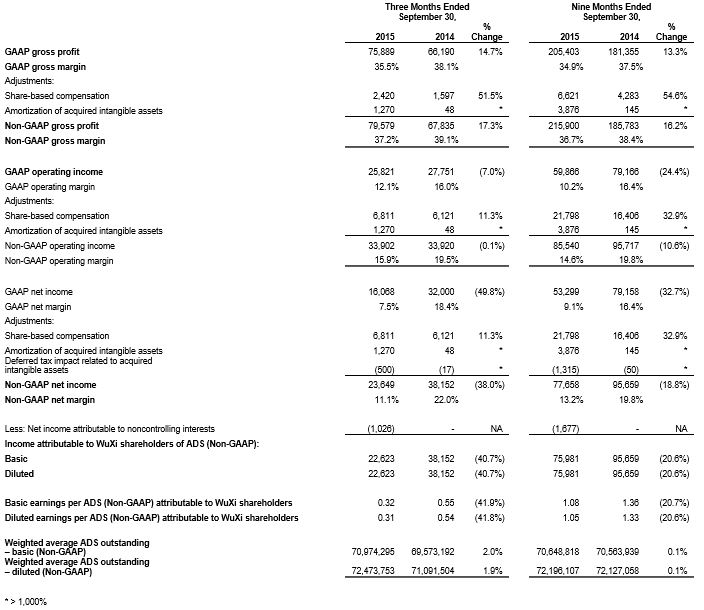

Third-Quarter 2015 Non-GAAP Results

Non-GAAP financial results exclude the impact of share-based compensation expenses and the amortization of acquired intangible assets and the associated deferred tax impact.

Third-quarter 2015 non-GAAP gross profit increased 17.3% year over year to $79.6 million due to 23.1% revenue growth, partially offset by increased labor costs in China and investments in new businesses. Non-GAAP gross margin decreased year over year to 37.2% from 39.1% for the same reasons.

Third-quarter 2015 non-GAAP operating income was substantially unchanged at $33.9 million due to investments in new businesses, including increased selling and marketing, general and administrative, and research and development expenses and transaction expenses related to the proposed privatization, substantially offset by the 17.3% increase in non-GAAP gross profit. Non-GAAP operating margin decreased to 15.9% from 19.5% due to higher operating expenses.

Third-quarter 2015 non-GAAP net income decreased 38.0% year over year to $23.6 million mainly due to an unfavorable change of $9.4 million in mark-to-market gains and losses on foreign-exchange forward contracts (losses of $7.3 million in the third quarter of 2015 compared to gains of $2.1 million in the third quarter of 2014), an adverse change in realized gains and losses on settled foreign-exchange forward contracts (losses of $1.6 million in the third quarter of 2015 compared to gains of $1.5 million in the third quarter of 2014), larger equity-method investment losses from our joint ventures with PRA and MedImmune and other equity-method investments, and higher interest expense due to higher loan balances needed to support increased investment.

Third-quarter 2015 non-GAAP net income attributable to WuXi shareholders decreased 40.7% year over year to $22.6 million mainly due to the 38.0% year-over-year decrease in net income and net income attributable to noncontrolling interests of $1.0 million in the third quarter of 2015.

Third-quarter 2015 non-GAAP diluted earnings per ADS attributable to WuXi shareholders decreased 41.8% year over year to $0.31 due to the 40.7% decrease in net income attributable to WuXi shareholders and a higher number of outstanding ADSs as a result of share issuances relating to the XenoBiotic Laboratories acquisition and vesting of restricted stock units.

Third-Quarter 2015 Results Preliminary; Upcoming WuXi Extraordinary General Meeting

The third-quarter 2015 results contained in this press release are preliminary, unaudited and unreviewed and are being released ahead of the upcoming extraordinary general meeting (or "EGM") of the WuXi shareholders. The EGM is scheduled to be held on November 25, 2015 at 10:00 a.m. Shanghai time at the executive offices of the Company located at 288 Fute Zhong Road, China (Shanghai) Pilot Free Trade Zone, Shanghai, 200131, People's Republic of China and is being convened to consider and vote on, among other matters, the proposal to authorize and approve the previously announced agreement and plan of merger dated as of August 14, 2015 and amended on October 20, 2015, among the Company, New WuXi Life Science Limited and WuXi Merger Limited, and the transactions contemplated thereby (the "Merger Transactions"). The related transaction statement on Schedule 13E-3 and the proxy statement (the "Proxy Statement") attached as Exhibit (a)-(1) thereto were filed with the U.S. Securities and Exchange Commission (the "SEC") on October 20, 2015. Investors, shareholders and holders of American Depositary Shares of WuXi ("ADSs", each representing eight ordinary shares of WuXi) are urged to read carefully and in their entirety these materials and other materials filed with or furnished to the SEC when they become available, as they contain important information about the company, the proposed merger and related matters. The Proxy Statement was mailed to the Company's ADS holders on or about October 26, 2015 and to the Company's shareholders on or about November 2, 2015. The Special Committee of the Board, comprised of independent directors, that reviewed the transaction recommends that stockholders approve the transaction.

In light of the upcoming EGM and possible closing of the Merger Transactions shortly thereafter, WuXi does not intend to host a conference call to discuss the financial information contained in this press release, nor is the Company providing an update to its financial guidance.

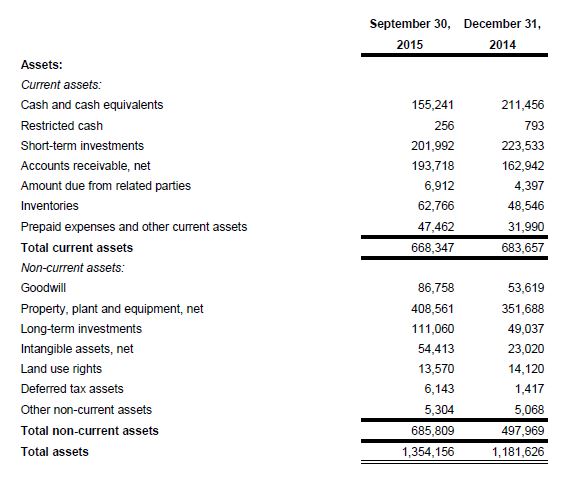

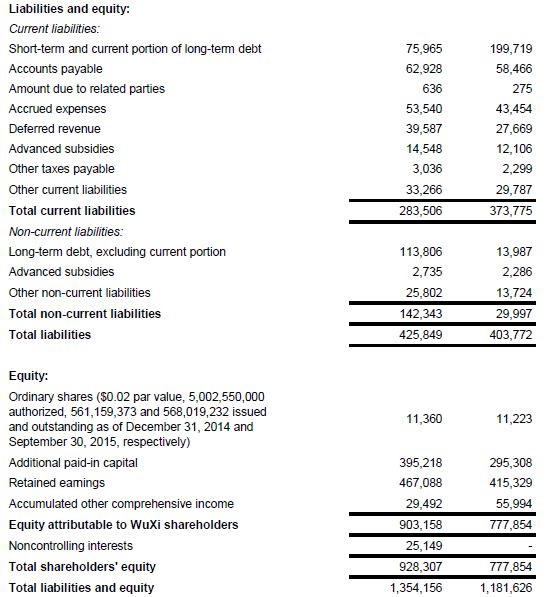

WUXI PHARMATECH (CAYMAN) INC.

UNAUDITED CONSOLIDATED BALANCE SHEETS

(in thousands of U.S. dollars, except ordinary share, ADS and par value data)

WUXI PHARMATECH (CAYMAN) INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands of U.S. dollars, except ADS data and per ADS data)

WUXI PHARMATECH (CAYMAN) INC.

RECONCILIATION OF GAAP TO NON-GAAP

(in thousands of U.S. dollars, except ADS data and per ADS data)

We have provided the above financial information on a non-GAAP basis, which excludes share-based compensation expenses and the amortization and deferred tax impact of acquired intangible assets. The non-GAAP financial measures used herein are useful for understanding and assessing underlying business performance and operating trends, and we believe that management and investors benefit from referring to these non-GAAP financial measures in assessing our financial performance and liquidity and when planning and forecasting future periods. You should not view non-GAAP results on a stand-alone basis or as a substitute for results under GAAP, or as being comparable to results reported or forecasted by other companies.

About WuXi PharmaTech

WuXi PharmaTech is a leading open-access R&D capability and technology platform company serving the pharmaceutical, biotechnology, and medical device industries, with operations in China and the United States. As a research-driven and customer-focused company, WuXi PharmaTech provides a broad and integrated portfolio of services throughout the drug and medical device R&D process. WuXi is also building a platform to provide clinical diagnostic services directly to physicians and their patients globally. WuXi PharmaTech's services are designed to assist its global partners in shortening the cycle and lowering the cost of drug and medical device R&D. WuXi PharmaTech's operating subsidiaries are known as WuXi AppTec. For more information, please visit: http://www.wuxiapptec.com.

Forward-Looking Statements

This press release may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts, but instead are predictions about future events. Although we believe that our predictions are reasonable, future events are inherently uncertain, and our forward-looking statements may turn out to be incorrect. Our forward-looking statements are subject to risks relating to, among other things, the proposed privatization transaction, our ability to control our costs and sustain revenue growth, to realize the anticipated benefits of our investments, to protect our clients' intellectual property, to compete effectively, and to complete the expansion of our small-molecule manufacturing facilities in Changzhou and other manufacturing facilities and potential co-development and acquisition activities. Additional information about these and other relevant risks can be found in our Annual Report on Form 20-F for the year ended December 31, 2014. The forward-looking statements in this press release speak only as of the date on which they are made, and we assume no obligation to update any forward-looking statements except as required by law.

Use of Non-GAAP Financial Measures

We have provided the third-quarter 2014 and 2015 financial information on a non-GAAP basis, which excludes share-based compensation expenses and the amortization and deferred tax impact of acquired intangible assets. The non-GAAP financial measures used in this press release are useful for understanding and assessing underlying business performance and operating trends, and we believe that management and investors benefit from referring to these non-GAAP financial measures in assessing our financial performance and liquidity and when planning and forecasting future periods. We expect to continue to provide such non-GAAP financial measures on a quarterly basis using a consistent method. You should not view non-GAAP results on a stand-alone basis or as a substitute for results under GAAP, or as being comparable to results reported or forecasted by other companies.

Statement Regarding Preliminary Unaudited Financial Information

The preliminary third quarter 2015 financial information in this press release is unreviewed, unaudited and subject to adjustment. Actual results could differ, perhaps materially, following any review of our 2015 quarterly financial information. Similarly, our quarterly results are subject to adjustment in conjunction with the audit of our annual financial results by our independent auditor.

For more information, please contact:

Ronald Aldridge

LaVoieHealthScience

Tel: +1-617-374-8800 x 109

Email: ron_aldridge@wuxiapptec.com

raldridge@lavoiehealthscience.com

Daniel H. Burch

MacKenzie Partners, Inc.

Tel: 212-929-5748 (O) 516-429-2721 (M)

Email: dburch@mackenziepartners.com